How Hugh Hendry’s Net Worth Reflects His Contrarian Career and Philosophy

When you first look into Hugh Hendry’s net worth, you’re not just looking at a number—you’re looking at a philosophy. Hendry isn’t your typical financier, and his wealth doesn’t come from doing things the usual way. His fortune reflects a career built on questioning consensus, betting against the crowd, and leaning into chaos when others fled from it. From making headlines during the 2008 financial crisis to reinventing himself as a sharp, philosophical media figure, Hendry’s trajectory isn’t about chasing money—it’s about challenging ideas. His net worth, estimated between $100 million and $200 million, is the byproduct of an unconventional mind navigating an unpredictable world.

Who Is Hugh Hendry? From Glasgow to Global Finance

To understand the numbers, you have to understand the man. Hugh Hendry was born in Glasgow, Scotland, in 1969 and raised in a working-class environment. He later attended the University of Strathclyde, where he studied economics and finance. His journey into the financial world wasn’t driven by privilege or pedigree, but by curiosity and ambition. He started his career at Baillie Gifford, a respected Edinburgh-based investment firm, and later moved to Credit Suisse Asset Management in London, where he honed his skills as an analyst.

Hendry eventually made a name for himself as a fund manager at Odey Asset Management, working under the famously outspoken Crispin Odey. But it was in 2005 that he took a pivotal step—founding his own hedge fund, Eclectica Asset Management. The firm quickly became known for its macroeconomic bets and its willingness to stray from the herd. Hendry gained a reputation as a “contrarian investor,” someone who didn’t just take risks but took them with a philosophical backing. He wasn’t interested in conventional wisdom. He was interested in finding the cracks that others ignored—and profiting from them.

His most famous moment came during the 2008 financial crisis. While many investors were blindsided by the collapse of the housing market and the unraveling of global finance, Hendry had positioned Eclectica to benefit from the turmoil. He was one of the few voices warning about systemic fragility before it became obvious. His fund’s returns soared, and so did his media presence. He was frequently interviewed, quoted, and invited to speak—not because he echoed what others were saying, but because he didn’t.

Breaking Down Hugh Hendry’s Net Worth

So where does Hugh Hendry net worth stand today, and what are the key sources behind it? Estimates vary, but most peg it between $100 million and $200 million. That wide range is partially due to the private nature of hedge fund earnings and offshore holdings, but it reflects the scale and complexity of his career. His fortune is the sum of bold market calls, diversified investments, and a unique ability to stay relevant even after leaving the traditional financial world. Let’s unpack the main components that contribute to his wealth.

Hedge Fund Success and Investment Earnings

At the heart of Hugh Hendry’s financial success is his time at the helm of Eclectica Asset Management. Running a hedge fund isn’t just about managing client money—it’s about profiting from the structure itself. Hedge fund managers typically earn through two streams: management fees (usually around 2% of assets under management) and performance fees (often 20% of profits generated). During the peak years of Eclectica, Hendry was managing hundreds of millions of dollars. Even in less volatile years, the fees alone could amount to millions annually.

More important, Hendry often had personal capital invested alongside his clients’. That meant when the fund did well—especially during the crisis years—his own net worth jumped alongside it. His prescient bets during the 2008 meltdown weren’t just good for his reputation; they were good for his bottom line. Profits made from correctly betting against the housing market, shorting banks, or hedging with gold and bonds translated into real, lasting wealth. While Eclectica closed in 2017, the years it thrived likely set Hendry up financially for the long haul.

Real Estate and Offshore Assets

Like many wealthy investors, Hugh Hendry hasn’t kept his money in one place. One of his more colorful chapters involves his move to the Caribbean—specifically, the luxury island of St. Barts. After shuttering Eclectica, Hendry transitioned into what he’s described as a more laid-back, reflective lifestyle. But don’t confuse that for a retreat. His real estate investments in St. Barts—including high-end properties, boutique developments, and vacation rentals—aren’t just indulgent; they’re lucrative.

Real estate in St. Barts is among the most expensive and in-demand in the world. It attracts high-net-worth individuals and celebrities, offering both capital appreciation and rental income. For someone like Hendry, who understands cycles and market timing, these properties serve as both lifestyle assets and strategic investments. It’s likely that a significant portion of his net worth is tied up in these holdings, appreciating steadily while providing tax-efficient shelter.

Media, Consulting, and Brand as a Public Intellectual

In recent years, Hendry has become something few hedge fund managers ever attempt to be—a public intellectual. Through his podcast appearances, YouTube channel, and financial commentary, he’s cultivated a second act as a thinker who isn’t afraid to mix philosophy, history, and economics. His musings, often delivered with a surreal or poetic flair, have drawn a niche but devoted following.

This media presence isn’t just about maintaining relevance—it’s monetizable. Podcasts and YouTube channels can generate revenue through sponsorships, ads, and affiliate partnerships. Consulting opportunities also arise when a high-profile thinker like Hendry offers his insights to institutions, family offices, or even boutique investment firms. And let’s not forget the power of the personal brand. Hendry’s voice is distinct. He’s not just selling analysis; he’s selling perspective. In a media landscape hungry for original thought, that’s valuable.

Lifestyle and Public Persona

What makes Hugh Hendry’s wealth story especially intriguing is how it reflects his values. He’s never chased the typical billionaire lifestyle. Instead, he’s styled himself as what he calls a “gentleman capitalist.” He surfs. He reads. He talks about spirituality and metaphysics as easily as he discusses bond yields. His interviews feel more like philosophical salons than CNBC segments. This persona is part of his brand, but it’s also part of his financial structure.

Living in St. Barts, for example, isn’t just aesthetically pleasing—it’s tax-efficient. The island’s favorable financial laws allow high-net-worth individuals to preserve and grow their wealth in ways that London or New York cannot. Hendry’s relatively low public profile (compared to other hedge fund stars) also shields him from scrutiny and distraction. He’s not looking for press hits or billion-dollar valuations. He’s looking for autonomy. And that shows in how he manages and spends his wealth.

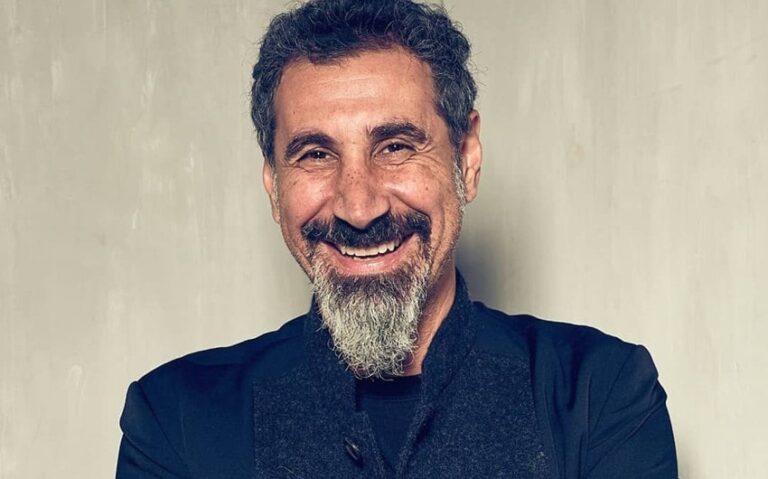

Featured Image Source: bloomberg.com