Jamie Dimon’s Net Worth and How He Built a Financial Powerhouse

When you think about powerful figures in banking, Jamie Dimon’s name often comes to mind. As the longtime CEO of JPMorgan Chase, he’s known for steering one of the world’s largest financial institutions through both crisis and growth. His leadership style, sharp insights, and steady presence on Wall Street have earned him respect—and significant wealth. That’s why so many are curious about Jamie Dimon’s net worth, not just as a number, but as a reflection of decades spent navigating the highs and lows of global finance with strategy, confidence, and an eye for long-term success.

Who Is Jamie Dimon?

Jamie Dimon was born on March 13, 1956, in New York City, into a family with strong ties to the financial industry. His grandfather and father were both stockbrokers at Shearson, giving Dimon an early view into the world he would one day dominate. But despite his lineage, Jamie’s path wasn’t one of inheritance—it was built through hard work, elite education, and a deep understanding of economics and leadership.

Dimon attended the prestigious Browning School in Manhattan and later earned his undergraduate degree from Tufts University, where he studied psychology and economics. He then went on to Harvard Business School, where he graduated in 1982 with an MBA. At Harvard, he was recruited by Sandy Weill, a powerful figure in the financial industry, to join American Express. This partnership would become a pivotal turning point in Dimon’s career.

Under Weill’s mentorship, Dimon rose rapidly. He followed Weill from American Express to Commercial Credit, and eventually played a key role in a series of mergers that culminated in the creation of Citigroup. However, Dimon’s relationship with Weill eventually soured, leading to his departure from Citigroup in 1998. What looked like a setback turned into one of the most important turning points in his life.

In 2000, Dimon became CEO of Bank One, the sixth-largest bank in the United States at the time. Just four years later, JPMorgan Chase acquired Bank One, and Dimon became president and chief operating officer of the combined company. By 2005, he was named CEO of JPMorgan Chase, and in 2006, he took on the additional role of chairman of the board.

Since then, Dimon has not only maintained his leadership position but has consistently elevated the bank’s global standing. Under his tenure, JPMorgan Chase has grown to become the largest bank in the United States by assets and one of the most respected financial institutions in the world. His career has been defined by a mix of calculated risk-taking, strategic thinking, and a reputation for speaking candidly on economic and regulatory issues.

Jamie Dimon’s Net Worth: Estimated Value and Income Sources

Jamie Dimon’s estimated net worth of $1.6 billion may not place him among the likes of tech billionaires, but in the world of finance and banking, it’s a remarkable achievement. What sets Dimon apart is not just the size of his wealth, but how it was accumulated—steadily, strategically, and with a long-term mindset. His net worth is derived from a combination of high executive compensation, stock ownership, private investments, and strategic advisory roles.

Annual Compensation

As CEO of JPMorgan Chase, Dimon receives one of the highest executive compensation packages on Wall Street. His annual pay typically includes a base salary, performance-based bonuses, and stock options. In recent years, Dimon’s total compensation has ranged from $30 million to $35 million per year, depending on the bank’s performance and shareholder approval.

For example, in 2023, his total compensation package was reported at $34.5 million, including a base salary of $1.5 million and a combination of performance incentives and stock awards that made up the rest. These packages often come with multi-year vesting periods, which means the real value is realized over time—especially when JPMorgan’s stock performs well.

Dimon has also been granted special retention bonuses at times, including options that could pay out tens of millions if the company hits specific long-term performance goals. These incentives not only reward Dimon but also help ensure that he remains at the helm, providing continued leadership to the bank’s operations.

Equity Holdings

Perhaps the most significant contributor to Jamie Dimon’s net worth is his extensive holdings in JPMorgan Chase stock. Dimon owns over 8 million shares of JPMorgan, which are valued at more than $1.3 billion based on current market prices. This stock ownership ties his personal wealth directly to the long-term performance of the bank—aligning his interests with shareholders and reinforcing his role as a steward of sustainable growth.

These shares were acquired through a mix of stock awards, performance-based grants, and personal purchases. Unlike some executives who rapidly sell shares, Dimon has held onto most of his stock, reinforcing his belief in the long-term value of the company he leads.

In addition to JPMorgan stock, it’s likely that Dimon holds a diverse investment portfolio that includes other equities, fixed income products, and potentially private equity or hedge fund interests—though much of this information remains private.

Other Investments and Assets

While the bulk of Jamie Dimon’s net worth is concentrated in JPMorgan Chase stock, he has also invested in other assets over time. Dimon owns real estate, including a residence in New York and additional properties that have not been publicly disclosed in detail.

It’s common for high-net-worth individuals like Dimon to invest in blue-chip real estate, art, private companies, and financial products that offer stability and long-term returns. Given his experience and connections in the financial world, it’s likely that Dimon has access to exclusive investment opportunities that further strengthen his portfolio.

He also receives income from board participation, advisory roles, and public speaking, though he is selective about where and how he appears. His reputation as a thought leader in economics and finance gives him access to influential circles in both public and private sectors.

Speaking and Board Positions

Although Dimon isn’t a frequent public speaker in the traditional celebrity sense, his opinions are highly valued in the world of economics and finance. He frequently speaks at investor conferences, banking summits, and policy forums, often earning honorariums or fees for his appearances. However, he is more likely to use these opportunities to influence policy and shape economic discussions rather than seek personal gain.

He also serves on various business councils and advisory boards. While these roles may come with financial benefits, their true value lies in expanding his influence and visibility in key sectors beyond banking. Dimon has also advised several presidential administrations, cementing his role as a bridge between government and Wall Street.

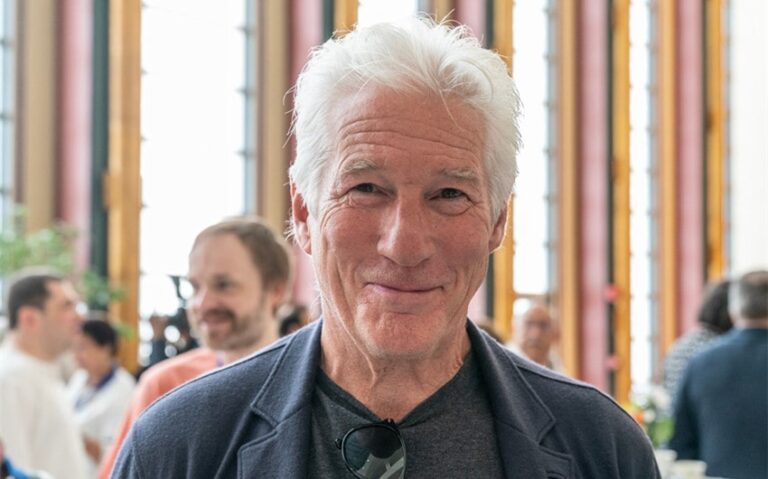

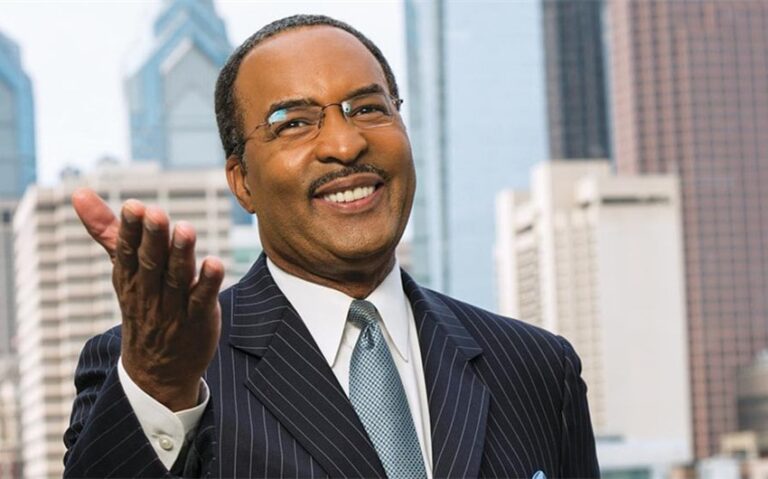

Featured Image Source: fortune.com