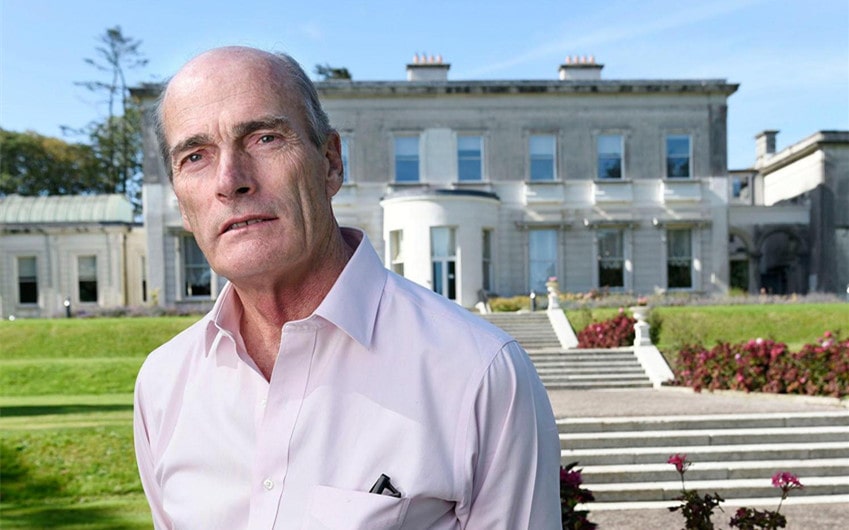

Bill Bonner’s Net Worth: Publishing Power and the Wealth of Ideas

When you ask about Bill Bonner’s net worth, you’re really asking how one man turned a lifetime of contrarian thinking, financial commentary, and entrepreneurial instinct into a global publishing empire. As of 2025, Bill Bonner’s estimated net worth is between $950 million and $1.1 billion. While his name may not be as familiar as celebrity CEOs or Wall Street power players, Bonner has amassed substantial wealth through an empire built on words, ideas, and deep skepticism of mainstream economics.

As the founder of Agora Inc.—one of the largest independent financial publishing networks in the world—Bonner has quietly influenced millions of readers while creating a sprawling, international business that bridges finance, real estate, and intellectual independence.

Who Is Bill Bonner? Building an Empire of Independent Ideas

Bill Bonner began his professional life in law but quickly found his voice in publishing. In 1978, he founded Agora Inc., headquartered in Baltimore, Maryland. What started as a small newsletter operation grew into a vast international network of financial publications, training courses, investment analysis, and media brands. Today, Agora reaches millions of subscribers in countries across the globe, offering economic forecasts, wealth-building strategies, and political commentary that often challenges the mainstream narrative.

Bonner’s voice has always been distinctly contrarian. He built his reputation by calling out bubbles, questioning central bank policy, and predicting financial crises long before they happened. His insights, while often uncomfortable, attracted a devoted following of readers who valued skepticism, critical thinking, and independence over media spin or Wall Street gloss.

But Bonner isn’t just a newsletter mogul. He’s also an accomplished author, real estate investor, and global entrepreneur. His work often blends economic theory with cultural observation, history with financial strategy. That combination of clarity, irreverence, and deep research has made him one of the most respected—and wealthy—figures in the world of independent finance.

What Is Bill Bonner’s Net Worth?

Bill Bonner’s net worth, estimated between $950 million and $1.1 billion, reflects a rare kind of wealth: the slow, steady accumulation of capital through ownership of intellectual property, recurring revenue streams, and diversified investments. While he has rarely chased publicity or public stock valuations, his financial footprint is vast. Let’s look at the pillars that support his wealth.

Agora Inc. and Financial Publishing

The heart of Bonner’s fortune is Agora Inc., the media company he founded and led for decades. Agora operates as an umbrella organization that owns and manages dozens of financial publishing brands, including Stansberry Research, The Oxford Club, Laissez Faire Books, and Bonner & Partners. These brands produce investment newsletters, economic forecasts, training programs, and niche financial analysis for a subscriber base numbering in the millions.

Unlike traditional media companies that rely on advertising revenue, Agora’s model is primarily subscription-based. That means predictable, recurring income driven by reader loyalty. Many of its services are structured in tiers, with entry-level newsletters leading to premium services that can cost thousands of dollars per year. With such a scalable model, even a modestly priced publication can become a major revenue source when offered to a global audience.

Agora’s reach isn’t limited to the U.S. The company has established operations in Europe, South America, and Asia, adapting its content to local markets while maintaining a shared focus on independent finance. This international footprint not only protects the company from economic downturns in any one country but also expands its influence—and Bonner’s wealth—on a truly global scale.

Book Sales and Investment Insights

Bonner has authored several bestselling books that further reinforce his brand and expand his income. Titles like Empire of Debt (co-written with Addison Wiggin), Mobs, Messiahs, and Markets, and Hormegeddon blend sharp financial insight with cultural critique. These books appeal not just to investors, but to readers seeking to understand the deeper patterns driving history, politics, and money.

While book sales alone don’t account for a huge portion of Bonner’s net worth, they do feed into the ecosystem he’s created. His writing leads readers to his newsletters. His newsletters lead to higher-tier services. And everything feeds back into the Agora model. It’s a holistic, idea-driven enterprise where every piece of content reinforces the next.

Bonner’s investment insights—whether published in books or shared through his private letters—have been credited with helping readers avoid major financial pitfalls and capitalize on under-the-radar opportunities. While he doesn’t run a hedge fund or manage money directly, his influence has likely affected the investment strategies of tens of thousands of individual investors.

Real Estate Holdings and Global Ventures

In addition to publishing, Bonner has invested heavily in real estate—both as an asset class and as a lifestyle. He owns properties in several countries, including a chateau in France, an estancia (ranch) in Argentina, and estates in the United States. These properties aren’t just homes; they’re often used in promotional material, writing retreats, and business events that further amplify his brand.

His South American property, in particular, has been featured in his writing and has even hosted clients and partners. Investing in real estate across continents has helped Bonner diversify his holdings and protect against regional volatility—a strategy he often advocates for his readers.

Bonner has also been involved in ventures such as winemaking, agriculture, and alternative energy—all extensions of his worldview and investment philosophy. These aren’t just side projects; they reflect a belief in tangible assets, self-reliance, and long-term thinking.

Private Investments and Business Incubation

Bonner’s wealth also comes from his role as an incubator and investor in other businesses. Through Agora and personal capital, he has funded numerous startups, including publishing ventures, education platforms, and fintech experiments. While many of these are privately held and not widely reported, they add depth and resilience to his financial profile.

He has also been a mentor and partner to many financial writers and thinkers who have gone on to build their own media brands under the Agora umbrella. This has created a network effect where Bonner’s influence and profit-sharing extend far beyond the projects he runs directly.

His ability to spot emerging trends—whether in macroeconomics, cultural movements, or digital media—has allowed him to stay ahead of the curve. That foresight is not just intellectual. It’s profitable.

Featured Image Source: thetimes.com